Content

Contrary to single-entry accounting, which tracks only revenue and expenses, double-entry accounting tracks assets, liabilities and equity, too. Similarly, another step of an accounting cycle is to prepare financial statements. All financial statements whether a balance sheet, income statement or a cash flow statement use the double-entry system for efficiency and accuracy of financial transactions recorded.

https://www.bookstime.com/ing transactions and keeping financial records are an essential part of owning a business. One way you can keep track of your finances is by using double-entry accounting. Read on to learn what is double-entry accounting and how it can benefit your books. Another example might be the purchase of a new computer for $1,000. You would need to enter a $1,000 debit to increase your income statement “Technology” expense account and a $1,000 credit to decrease your balance sheet “Cash” account.

Accounts are Fundamental Building Blocks of the Accounting System

The DEAD rule is a simple mnemonic that helps us easily remember that we should always Debit Expenses, Assets, and Dividend accounts, respectively. The normal balance in such cases would be a debit, and debits would increase the accounts, while credits would decrease them. Once one understands the DEAD rule, it is easy to know that any other accounts would be treated in the exact opposite manner from the accounts subject to the DEAD rule. Here, the asset account – Furniture or Equipment – would be debited, while the Cash account would be credited.

- Financial Metrics ProKnow for certain you are using the right metrics in the right way.

- This example shows us the relation of double-entry, with the rule of debits and credits.

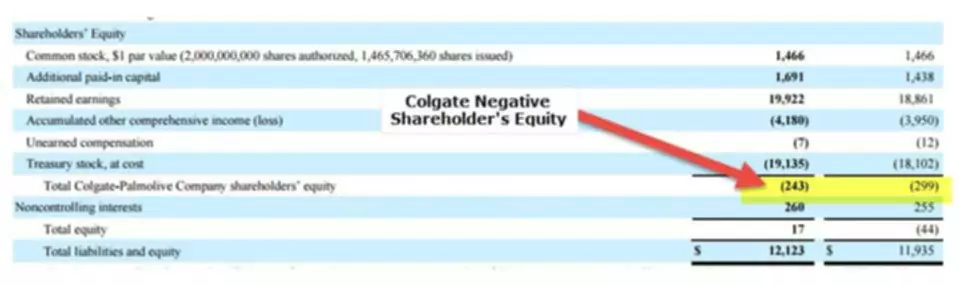

- Increase in shareholders equity account will be recorded via a credit entry.

- Business professionals who understand core business concepts and principles fully and precisely always have the advantage.

- With double-entry in accounting, record two or more entries for every transaction.

Merchants began selling “on double entry accounting meaning,” forming partnerships and companies, obtaining funding from private banks, and covering business investments with insurance. These include activities that complex businesses must track and manage, but which are invisible to simpler accounting systems. The double-entry bookkeeping method is based on the idea that every business transaction has equal and opposite effects on at least two accounts. Once your chart of accounts is set up and you have a basic understanding of debits and credits, you can start entering your transactions. The cash balance declines as a result of paying the commission, which also eliminates the liability. The reason your debit card is called a debit card is because the bank shows your balance as a liability because they owe your money to you—in essence, they are just holding it for you.

How to get started with double-entry accounting

Credits to one account must equal debits to another to keep the equation in balance. Accountants use debit and credit entries to record transactions to each account, and each of the accounts in this equation show on a company’s balance sheet. Debits and credits are very important to the double-entry system. In accounts, debit refers to an entry on the left side of the accounting ledger, and credit is defined as an entry that is recorded on the right side of the account.